Loan Transactions, Made Simple

EQUIPMENT FINANCING & SMALL BUSINESS LENDING

Empowering Business Growth

with Flexible Financing

At CMS Funding, we help small businesses thrive by providing fast, flexible, and reliable financing solutions. With more than 20 years of experience, we understand the challenges of securing the capital needed to grow. That’s why we are committed to delivering seamless funding options with a customer-first approach, ensuring businesses can access the equipment and working capital they need—without the hassle.

- $10,000 to $5,000,000

- Terms up to 84 months

- New and Pre-Owned Equipment

- 100% Financing including soft costs

- Prefunding options available

.png?width=1200&length=1200&name=banner-img3-1%20(1).png)

Equipment Financing

> $10,000 to $5,000,000

> Terms up to 84 month

> New and Pre-Owned Equipment

> 100% Financing including soft costs

> 100% Financing including soft costs

> Prefunding options available

.png?width=1200&length=1200&name=banner-img3-1%20(1).png)

Equipment Financing

> $10,000 to $5,000,000

> Terms up to 84 month

> New and Pre-Owned Equipment

> 100% Financing including soft costs

> 100% Financing including soft costs

> Prefunding options available

Growth theme

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Speak With Our Team

To speak with the Cresset Capital Lending Team directly, please contact:

Cresset Capital

Cresset Capital

Lending Team

E: lending@cressetcapital.com

T: (555) 555-5555

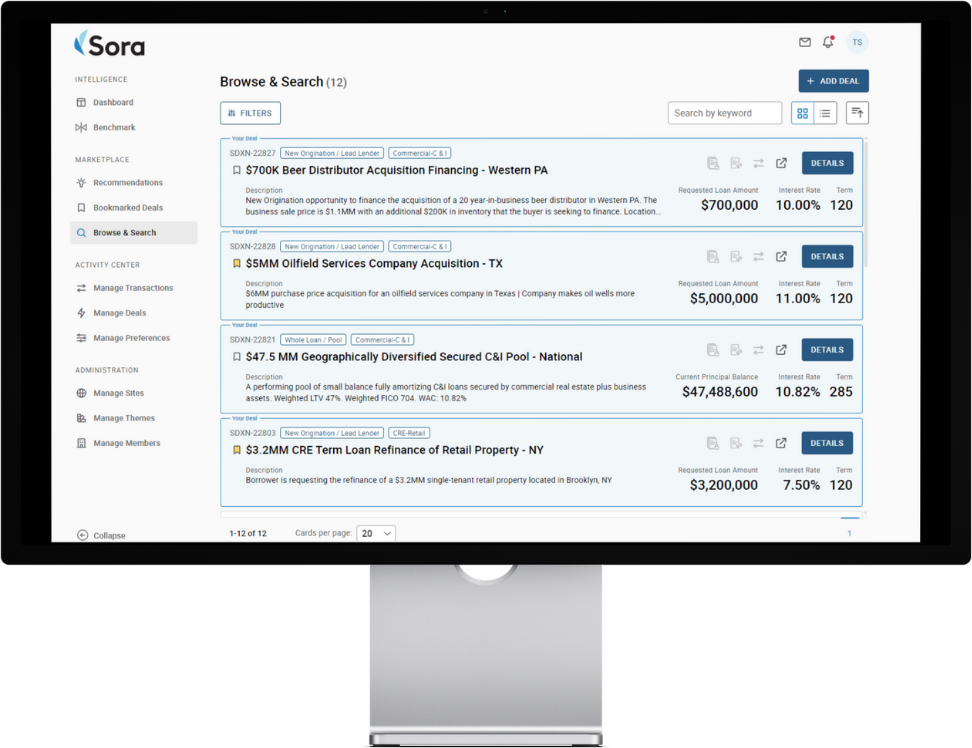

Access a Nationwide Network of Financial Institutions & Other Originators

Current PNC Bank Members include:

Exploring Lending Solutions with Your Clients | Overview

Learn more about the service, the diverse loan options available, the essential questions to ask during client discussions as well as the step-by-step process -- from initiating the conversation to guiding clients through loan origination. Discover how our team supports you and your clients at each juncture.

Value Add for

Wealth Managers & Clients

Solution Highlights

-

EXCEPTIONAL ACCESS

Nationwide network of over 1,400 institutions available on-demand to review each client opportunity

-

DIVERSE OPTIONS

Lending solutions across multiple asset class and loan types ensures that almost any client credit need can be supported

-

CONFIDENTIAL

All requests are posted anonymously - clients can post an inquiry and review proposals prior to sharing information

-

EXPERIENCED GUIDANCE

Each opportunity is reviewed and optimized by a dedicated team of credit specialists prior to posting on the marketplace

-

DEDICATED SUPPORT

The Sora & CCT teams work closely with you and the client at every step to facilitate communications with lenders

-

DEEPER CLIENT INSIGHTS

Providing credit solutions gives wealth managers an even deeper understanding of their client's financial needs, goals

Recent Case Study | Interstate Bank (TX)

" Finding loans to buy is frustrating for a bank our size. In the past, we have had to turn to five different sources to access five different types of loans. So having just one place to turn to that we can trust to help us with the entire process is a game changer..."

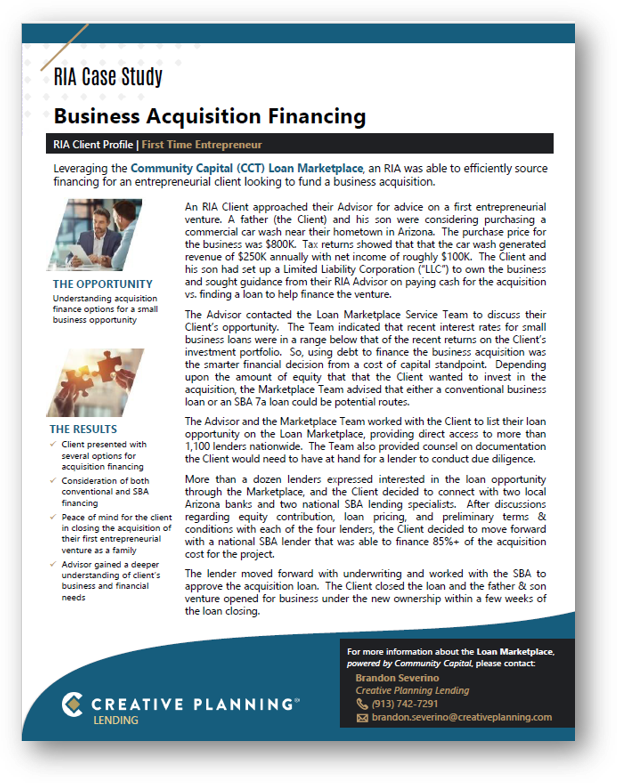

Creative Planning | Client Credit Opportunity Case Study

Frequently Asked Questions.

Security

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

Deal Flow

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

Lending Insights | Client Stories & Education

EDUCATION

More About Lending

-

| EDUCATION |

C&I LendingLearn more about Commercial & Industrial Loans and

how they can support client business growth. -

| EDUCATION |

CRE LendingLearn more about CRE loans and how they can

support clients' real estate needs.

-

| EDUCATION |

SBA 7a LendingLearn more about SBA 7a loans and how

they can support small business financing.

-

| EDUCATION |

| EDUCATION |

SBA 504 LendingLearn more about SBA 504 loans and howthey can support small business financing.

CASE STUDIES

Client Stories & Solutions

Commercial ("C&I") Loans

-

| CASE STUDY |

Acquisition Financing • Car WashEfficiently sourced financing for an entrepreneurial

client looking to fund a business acquisition. -

| CASE STUDY |

Franchise Finance • Father/Son PartnershipNew family entrepreneurial venture finds

attractive financing for franchise acquisitions.

-

| CASE STUDY |

Acquisition Financing • Oil & Gas ServicesPartners seek financing options to

support purchase of operating company.

-

| CASE STUDY |

CapEx & Debt Consolidation • FranchiseSecond-generation franchise owner sources loan

to finance capital expenditures

-

| CASE STUDY |

Franchise Finance • New TerritoryHusband & Wife team looking to acquire

new franchises to expand territory

Client Stories & Solutions

Commercial Real Estate ("CRE") Loans

Case Studies | Client Lending Stories

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis accumsan velit sit amet sagittis malesuada."

Commercial Lending

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Residential Mortgages

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Specialty Lending (SBLOC, Aviation, Marine)

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Commercial Lending

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Residential Mortgages

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Specialty | SBLOC, Aviation, Marine

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Something Powerful

Tell The Reader More

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

- Bullets are great

- For spelling out benefits and

- Turning visitors into leads.