Loan Transactions, Made Simple

FOR FINANCIAL ADVISORS

Client Lending Solution

powered by Community Capital (an AFG portfolio company)

Access, Guidance & Advocacy

Allegheny delivers tailored lending solutions that help your clients seize opportunities — whether they’re launching a new business, acquiring residential or commercial real estate, or seeking liquidity for personal or investment needs. In partnership with Community Capital (an AFG portfolio company), we provide direct, on-demand access to a nationwide network of trusted banks, credit unions, and specialty lenders, equipping you with a powerful tool to support your clients’ financial goals at every stage of growth.

A dedicated Capital Solutions Team is here to support you and your clients throughout the process with personalized, expert guidance at every stage. From identifying your client’s financing needs to sourcing competitive options and then supporting them through every step to loan closing, our aim is to ensure a smooth, results-driven experience.

To get started, you can connect with the Capital Solutions Team directly or share the client-facing link below to initiate the process. These secure forms allow clients to submit their own credit commercial, residential or specialty loan inquiries, starting a streamlined, high-touch journey that ensures you stay fully informed and engaged throughout.

Lending Solutions for Every Client... and Every Client Need

Whether your client is purchasing a home, refinancing, growing their business, or financing a unique asset, our Client Lending Solution, powered by Community Capital, provides direct access to a wide range of tailored lending solutions. Use the links below to direct clients to the loan inquiry sites. From there, they can explore loan options directly and start a request for either residential or commercial and specialty financing.

Once your client initiates the process, the CCT Capital Solutions Team steps in - managing lender sourcing and coordination, while keeping you informed and engaged every step of the way. Guiding clients to this page is the first step in delivering a seamless, high-touch lending experience.

Client Loan Inquiry | Start the Process

Curious what your clients will see? Use the links to explore the client experience for yourself... but importantly, this is the link to share directly with clients when a lending need arises.

The page is designed to guide them to the right solution based on loan type - residential or commercial and specialty - and walk them through a simple, step-by-step process to submit an inquiry. It is intuitive, simple, and gets them started in minutes.

You bring the client.

We’ll bring the expertise… and the capital.

Residential Mortgages

Whether your client is purchasing a primary residence, refinancing an existing home, or acquiring a vacation property, our residential mortgage solutions provide competitive options with concierge-level support. On the next page, your client can submit a loan inquiry to begin exploring mortgage options tailored to their needs.

Commercial & Specialty Loans

From business expansion and investment real estate to unique assets like aircraft or marine financing, our Commercial & Specialty loan solutions are designed to support a wide range of complex financing needs. Your client can submit a detailed inquiry on the next page to get matched with the right lending solution.

Client Loan Inquiry | Start the Process

Curious what your clients will see? Use the links to explore the client experience for yourself... but importantly, this is the link to share directly with clients when a lending need arises.

The page is designed to guide them to the right solution based on loan type - residential or commercial and specialty - and walk them through a simple, step-by-step process to submit an inquiry. It is intuitive, simple, and gets them started in minutes.

You bring the client.

We’ll bring the expertise… and the capital.

Residential Mortgages

Whether your client is purchasing a primary residence, refinancing an existing home, or acquiring a vacation property, our residential mortgage solutions provide competitive options with concierge-level support. On the next page, your client can submit a loan inquiry to begin exploring mortgage options tailored to their needs.

Commercial & Specialty Loans

From business expansion and investment real estate to unique assets like aircraft or marine financing, our Commercial & Specialty loan solutions are designed to support a wide range of complex financing needs. Your client can submit a detailed inquiry on the next page to get matched with the right lending solution.

Residential Mortgages

Whether your client is purchasing a primary residence, refinancing an existing home, or acquiring a vacation property, our residential mortgage solutions provide competitive options with concierge-level support. On the next page, your client can submit a detailed loan inquiry to begin exploring mortgage options tailored to their needs.

Commercial & Specialty Loans

From business expansion and investment real estate to unique assets like aircraft or marine financing, our Commercial & Specialty loan solutions are designed to support a wide range of complex financing needs. Your client can submit a detailed inquiry on the next page to get matched with the right lending solution.

To speak with the lending team directly, please contact:

CCT Capital Solutions

Tel: +1 (866) XXX-XXXX

Email: capitalsolutions@communityct.com

The FIG Advisory Whole Loan Desk is an experienced team focused on a holistic approach to supporting our clients' needs and financial goals. We provide strategic advice and tactical support to U.S. depository financial institutions across a range areas including balance sheet management, capital markets planning and investment banking M&A.

Access a Nationwide Network of Financial Institutions & Other Originators

Current PNC Bank Members include:

Exploring Lending Solutions with Clients Overview

Want to feel more confident introducing lending into your client conversations? These overview materials will give you everything you need to get started.

Download the overview and watch the short video to explore the AFG client lending solution, discover the range of loan options available, and see how easy it is to identify a lending need, guide the conversation, and engage the CCT Capital Solutions team. You’ll gain practical insight into the right questions to ask, how to gather key loan details, and what to expect once a request is submitted.

These materials, along with the educational content below, provide a practical roadmap that empowers you to engage with confidence and unlock new value in every client relationship.

Value Add for

AFG Advisors & Clients

Solution Highlights

-

EXCEPTIONAL ACCESS

Nationwide network of over 1,400 institutions available on-demand to review each client opportunity

-

DIVERSE OPTIONS

Lending solutions across multiple asset class and loan types ensures that almost any client credit need can be supported

-

ANONYMOUS

All requests are posted anonymously - clients can submit an inquiry and review interest prior to sharing information

-

EXPERIENCED GUIDANCE

Each opportunity is reviewed and optimized by a dedicated team of credit specialists prior to posting on the marketplace

-

DEDICATED SUPPORT

The CCT Capital Solutions Team works with the client at every step to facilitate the entire process through to closing

-

DEEPER CLIENT INSIGHTS

Offering credit solutions provides broader understanding of your client's financial needs and goals

Recent Case Study | Interstate Bank (TX)

" Finding loans to buy is frustrating for a bank our size. In the past, we have had to turn to five different sources to access five different types of loans. So having just one place to turn to that we can trust to help us with the entire process is a game changer..."

Creative Planning | Client Credit Opportunity Case Study

Frequently Asked Questions.

Security

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

Deal Flow

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

Lending Insights | Client Stories & Education

.png?width=1474&height=1248&name=AFG%20Allegheny%20Lending%20(1).png)

EDUCATION

More About Lending

Explore our library of educational resources to deepen your understanding of the loan types available through AFG Client Lending, powered by Community Capital. These one-page overviews are designed to help you confidently identify opportunities, start conversations, and guide clients toward the financing solutions that best fit their personal and business goals.

EDUCATION

More About Lending

Explore our library of educational resources to deepen your understanding of the loan types available through AFG Client Lending, powered by Community Capital. These one-page overviews are designed to help you confidently identify opportunities, start conversations, and guide clients toward the financing solutions that best fit their personal and business goals.

-

| EDUCATION |

| EDUCATION |

Residential MortgagesLearn more about financing options for your

clients' residential property needs. -

| EDUCATION |

C&I LendingLearn more about Commercial & Industrial Loans and

how they can support client business growth. -

| EDUCATION |

CRE LendingLearn more about CRE loans and how they can

support clients' real estate needs.

-

| EDUCATION |

SBA 7a LendingLearn more about SBA 7a loans and how

they can support small business financing.

-

| EDUCATION |

| EDUCATION |

SBA 504 LendingLearn more about SBA 504 loans and howthey can support small business financing. -

| EDUCATION |

| EDUCATION |

Specialty LoansLearn more about lending options

for unique assets like boats, planes, etc.

CASE STUDIES

Client Successes & Solutions

See Osaic CapitalHub in action. These real-world examples showcase how advisors and clients are leveraging Osaic’s CapitalHub to navigate complex financing needs, access the right lenders, and deliver meaningful outcomes. From time-sensitive acquisitions to liquidity solutions, home acquisitions, and strategic refinancings, each story highlights the power of personalized support, high-touch service, and the value of having a powerful lending solution behind you to significantly expand your relationships.

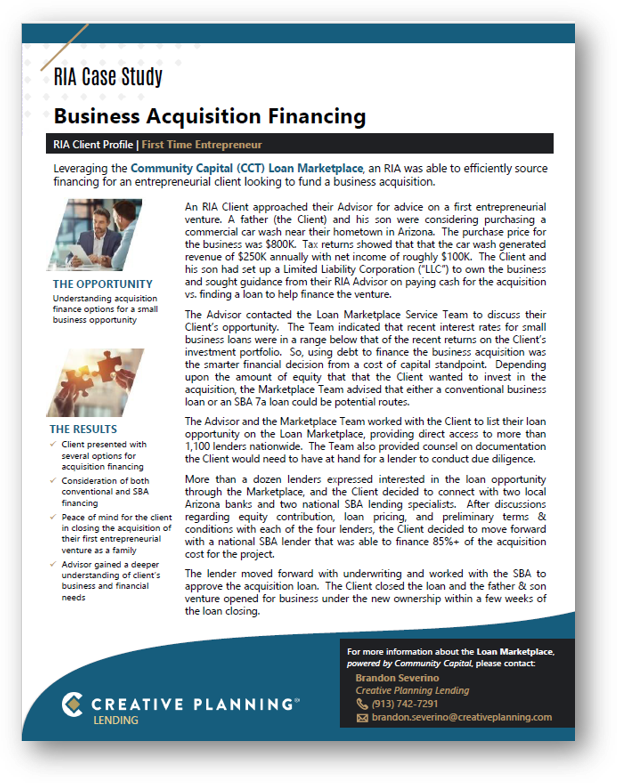

Commercial & Industrial ("C&I")

-

| CASE STUDY |

Acquisition Financing • Car WashEfficiently sourced financing for an entrepreneurial

client looking to fund a business acquisition. -

| CASE STUDY |

Franchise Finance • Father/Son PartnershipNew family entrepreneurial venture finds

attractive financing for franchise acquisitions.

-

| CASE STUDY |

Acquisition Financing • Oil & Gas ServicesPartners seek financing options to

support purchase of operating company.

-

| CASE STUDY |

CapEx & Debt Consolidation • FranchiseSecond-generation franchise owner sources loan

to finance capital expenditures

-

| CASE STUDY |

Franchise Finance • New TerritoryHusband & Wife team looking to acquire

new franchises to expand territory

Commercial Real Estate ("CRE")

CASE STUDIES

Client Successes & Solutions

See Osaic CapitalHub in action. These real-world examples showcase how advisors and clients are leveraging Osaic’s CapitalHub to navigate complex financing needs, access the right lenders, and deliver meaningful outcomes. From time-sensitive acquisitions to liquidity solutions, home acquisitions, and strategic refinancings, each story highlights the power of personalized support, high-touch service, and the value of having a powerful lending solution behind you to significantly expand your relationships.

Commercial & Industrial ("C&I")

Case Studies | Client Lending Stories

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis accumsan velit sit amet sagittis malesuada."

Commercial Lending

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Residential Mortgages

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Specialty Lending (SBLOC, Aviation, Marine)

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Commercial Lending

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Residential Mortgages

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Specialty | SBLOC, Aviation, Marine

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

To learn more about AFG's Client Lending Solution, please contact our partner CCT's Capital Solutions Team:

Capital Solutions Team

capitalsolutions@communityct.com

+1 (866) XXX-XXXX

AFG Client Lending is a being supported by the Allegheny Financial Group and Community Capital Technology Inc. AFG and CCT are not providing investment, legal, tax, financial, accounting, or other advice to you or any other party, and is not acting as an advisor or fiduciary in any respect in connection with providing this information.

FOR FINANCIAL PROFESSIONAL USE ONLY • alleghenyfinancial.com

© Allegheny Financial Group