Explore Residential Mortgage Solutions

Competitive options, powered by Community Capital and NBKC Bank

AFG Client Lending, powered by Community Capital, makes it easy to explore residential mortgage loan options and secure financing with confidence, whether you are purchasing a primary residence, second home, or investment property. Community Capital is Allegheny Financial’s dedicated lending marketplace partner, providing our clients with direct, efficient access to competitive financing solutions.

Submit a Loan Inquiry

Simple, Fast Mortgage Options

We are proud to offer Allegheny clients a more efficient, streamlined way to access home loan options, in partnership with Community Capital and NBKC Bank a leading mortgage originator. NBKC is a top-rated bank known for speed, transparency, and competitive mortgage pricing.

Through this exclusive offering, you gain access to preferred loan rates and a dedicated mortgage team will create a smooth experience and guide you every step of the way from application to close.

Click "Apply Now" to begin your loan application through NBKC’s secure loan portal. The application takes just a few minutes to complete. Once submitted, you'll receive a direct response from NBKC within 24 hours, including a review of your submission and personalized loan options designed to meet your specific financing needs.

Loan Request | Residential Mortgage

3 Simple Steps to Apply

Receive a quote in as quickly as 1 day

1. Click Loan Application Button

2. Complete Easy Application (5 min!)

3. Receive Quote* in about a day

*Once your application is submitted, your information will be reviewed and you will be contacted directly by an NBKC Mortgage Loan Officer to review your offer.

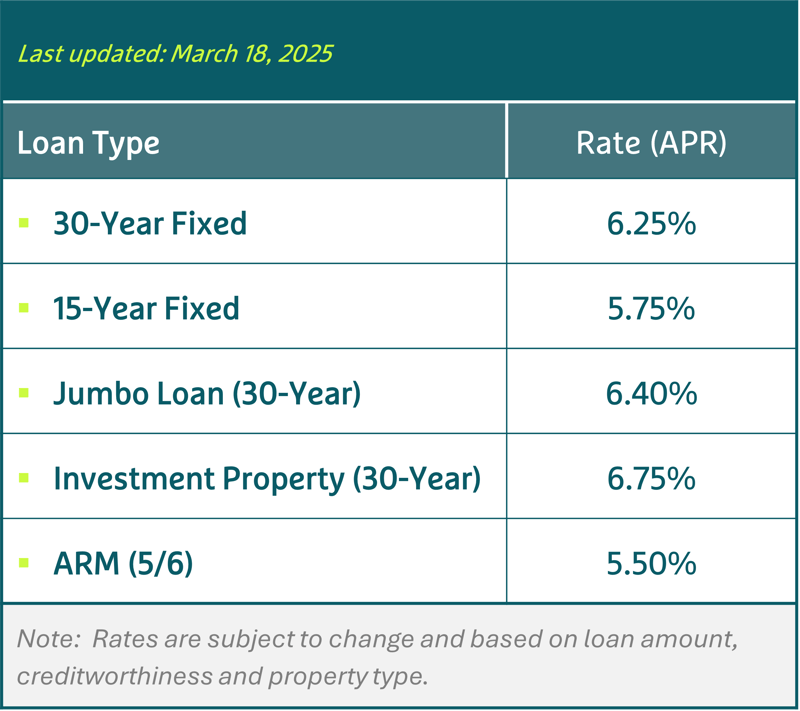

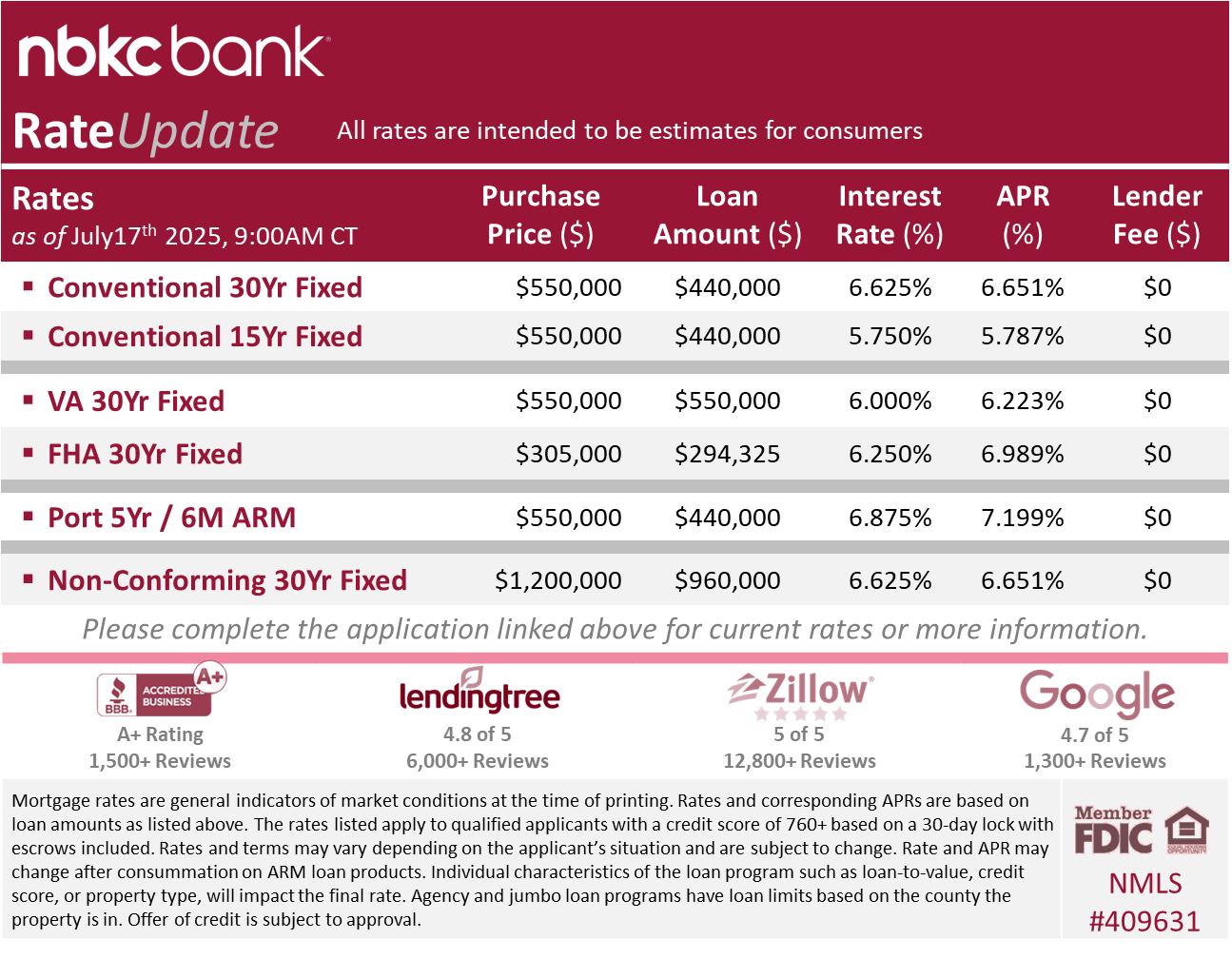

See What’s Possible

Explore a snapshot of current estimated rates for a range of standard mortgage products, including conventional, VA, FHA, and ARM options.

These rates are updated regularly to reflect market conditions, but rates may var based on individual applicant's situation.

To view personalized rates or begin the process, please complete the application linked above.

Please Note: Rates shown are estimates only and based on select assumptions, including high credit scores and typical loan structures. Your actual rate may vary depending on credit profile, loan amount, property type, and other factors.

Looking for a Commercial or Specialty Loan?

Not only do we offer solutions for residential loans, our Lending Solution also delivers access to business loans, commercial real estate (CRE) financing, SBA loans, equipment loans, and other specialty lending options (planes, boats). We make it easy - with a clear process, personalized support, and expert guidance shaped around your business or personal financing goals.

3 Simple Steps to Apply

Receive a quote as quickly as 1 day

1. Click Loan Application Button (above)

2. Complete Easy Application (5 minutes!)

3. Receive a Quote* within about a day

*Once your application is submitted, your information will be reviewed and you will be contacted directly by an NBKC Mortgage Loan Officer to review your offer.

Need Assistance?

If you have any questions before you get started, please contact our Team directly.

Contact Us:

Tel: +1 (866) XXX-XXXX

Email: capitalsolutions@communityct.com

%20-%20Copy.png)